Growing the family’s wealth in-line with the growth of the family is no easy feat.

Over several pieces we have taken a deep dive on the challenges family’s face in growing their wealth over time. We looked at target rates of return, and concluded that around 10% is a minimum threshold for many families. We’ve talked about how important sizing the amount of cash the family needs relative to the size of the portfolio, and how difficult those decisions are.

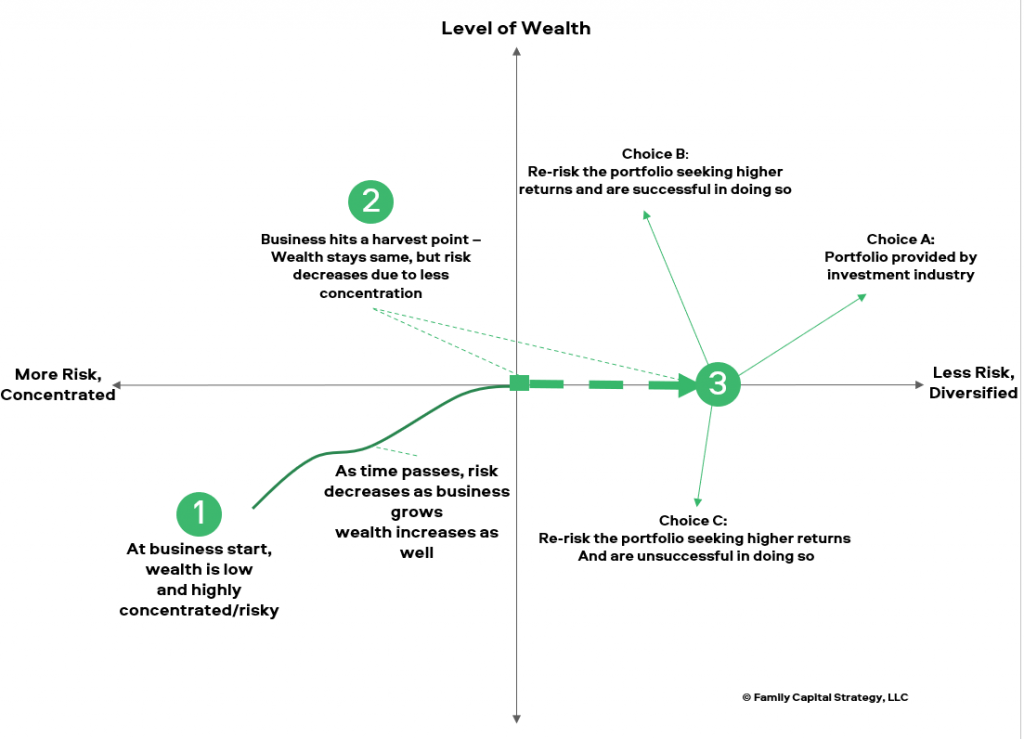

Most recently, we looked at the typical path that family wealth follows as it grows – see Figure 1.

Figure 1. Family Wealth Creation Pathway

Source: Family Capital Strategy

As a family reaches point 3 on the chart above, the family faces a significant choice in how it proceeds. If the family is serious and focused about continuing to grow its wealth, it is highly unlikely that a broadly diversified portfolio will achieve that target 10% rate of return. Instead, the family will have to architect an investment approach that increases the odds of a successful outcome, without risking the entire fortune.

So what are the key characteristics of such an approach?

First – at its core the family must continue to develop wealth creation as a core competency. Note that I did not say investment as a core competency. There will be some families who choose the path and develop the requisite skills to make investment activities a substantial source of new wealth.

It is much more likely however that the wealth creation capability of the family will be similar to how the family generated its wealth to begin with – through entrepreneurial vision and business building. In 2015, John Davis at the Cambridge Institute for Family Enterprise highlighted this noting that “in order to sustain and keep growing their wealth, business families need to make one or a few large bets with prudent risks in order to grow their wealth in every generation.”

This view is supported by the actual experience of families that have a long history of staying invested together. In 2012, research conducted by 3 professors found that on average business families in their history controlled 6.1 firms – having created 5.4, acquired 2.7 and spun off 1.5 firms. (See “From Longevity of Firms to Transgenerational Entrepreneurship of Families” by Zellweger, Nason, and Nordqvist).

This means that despite a family’s significant accomplishment in creating and building a thriving enterprise, multi-generational families continue to capture the same entrepreneurial energy and create new enterprises. Importantly, this act of creation not only is supportive of the continued growth of the wealth of the family, it also is a highly critical element of keeping the family together.

The second key element of a successful investment approach is that the family knows where each business asset is in its life-cycle. For families that are building their investment platform while retaining an existing business, it is critical that they understand that business’ potential. For businesses with a long growth road ahead and plenty of opportunity for reinvestment at high rates of return, the continued investment in the core business make sense to a point. Building a mentality and capability regarding the deployment of cash flows and capital will be a vital skill-set going forward.

“How do you beat Bobby Fischer? You play him at any game but chess. I try to stay in games where I have an edge.”

Warren Buffett

The third element for success is an unfair advantage. As we have discussed before, the greatest advantage a family has is its multi-generational time horizon. But while this is an advantage, it is not enough in itself to set the family up for success. The market place is highly competitive, with a broad range of choices that are all cloaked in appealing language.

In order to navigate this treacherous landscape, the family needs to carefully consider its unique skills, networks, knowledge and how they might be combined in such a manner to create an opportunity set that the family is uniquely and hopefully unfairly able to compete and win in.

Fourth – the family must create a unique process for realizing the advantage. While having a unique advantage is better than not having one at all, unless it is thoughtfully cultivated and deployed, it is of little value.

As such, the family must take this advantage and translate it into a scalable, replicable playbook for realizing their advantage. At this point, we commonly see families fall short. Wealth creation efforts become either a hobby or a passion (or vanity!?) project which fails to bring the intentional effort required for success. Whether the family were to raise outside capital to invest alongside their efforts, acting as if you had outside capital is a helpful litmus test for bench-marking.

It is worth highlighting a tension that is present which is the family’s success and wealth. When the founding entrepreneur began the first family business, he or she likely did so from a place of relative resource constraint. There was a forced element of hustle to figure out how to take an idea and grow it. When allocating from a position of material abundance, it is important to beware how those resources can in effect serve a limiting function on the creativity of the business.

Fifth – determine a level of capital to risk. Finding the right level of capital to invest in on-going wealth creation efforts is of critical importance. The family needs to retain enough liquidity to fund deaths, divorces and distributions – three common uses of family assets. There is a paradox in place here that if the family’s balance sheet wealth is never actually translated into cash flow – the family won’t take the business seriously. Similar, if there is too much cash flow available, it could potentially harm the family and may mean the family is not retaining enough assets to grow for future generations.

By our analysis, if a family is targeting that 10% rate of growth and assuming an asset allocation of 60% in public equities and 15% fixed income to fund cash needs, a ~20-25% allocation to funding future growth is not unreasonable. Enough capital must be deployed into the new opportunities to make an impact on the overall portfolio. But too much capital at risk in any given deal could risk substantively impairing the family’s net worth.

Finally – who will do the work? A commitment to grow for future generations is admirable as a vision. But the implementation of such a program centers around the question of who? Can the family continue to grow wealth creators or will they need to hire them? There are pros and cons to each approach – and there are highly successful families who have taken each approach.

Of course, with people comes the questions of compensation and rewards. The family must digest how it rewards those who create on-going wealth for the family, in light of market rates of compensation for such skills.

As we began with, building an investment approach that supports the growth of the family is not easy. There are areas of philosophical alignment that the family must agree on before embarking on such an approach. With those key inputs in place, the family must translate those into a differentiated investment program. Building such a program of continued wealth creation is a key element necessary for a family to stay together for three generations and beyond.

Disclaimer: This does not constitute investment advice or an offer to buy or sell any securities. It is provided for informational purposes only and represents the author’s own opinions. Target rates of return and asset allocations are unique to individual family circumstances. Readers are encouraged to contact their advisor to discuss their own circumstances.