Today, we want to continue our series looking at the challenges of a family compounding its wealth over time. In our first piece, “How Fast Must a Family’s Assets Grow?“ we looked at the significant headwinds facing families – from the growth of the family itself, to distributions, fees and taxes. We concluded that families looking to grow their wealth in a such a way where it increases pro-rata with the growth of the family are likely needing a rate of return of close to 10% (at least) annually over time.

The next two pieces we considered spending and the level of distributions in a family. “It’s Never About Just the Money, But It’s Never Not About the Money” we looked at the cultural challenges of discussing wealth. We discussed how often wealth is discussed in the negative form – either, passing along negative stories or spending shaming. Families will need to develop their ability to discuss wealth if they seek to grow their capital over time. Only by having such conversations can consensus be reached to take additional risk in the portfolio, or manage distributions to a certain level.

To that final point, in our next piece entitled “Distribution Rate – The Only Variable a Family Can Control in Investing” we talked about how families go about setting the appropriate level of distributions from a pool of family wealth. Choosing this level can have a huge impact on the portfolio, but requires the family to have a clear articulation of to what ends it wishes to deploy its wealth.

Yet even recognizing that distribution rate is the primary controllable variable for families, the reality is that distribution rate alone is unlikely to be adequate in helping the family’s wealth to grow fast enough over time. A 10% hurdle rate is extremely challenging to hit – almost near impossible to do in public markets alone – either due to generate the returns or from the volatility.

Of course the refrain is that most families lose their wealth by the third generation. Yet in many cases, this ‘loss’ of wealth is not due to catastrophic investment losses. Most often, the wealth just dwindles away as the family grows and the wealth gets divided. In fairly short order, without additional replenishment, a sizable fortune can be reduced.

It is important here to consider one additional challenge facing families – finding advice to assist them in their pursuit of multi-generational success. The reality is that most advisers, even at the most well-intentioned firms will not be willing to encourage the family to approach their investments in the way required to generate the necessary returns.

Hypothetically, one path to generating a 10% rate of return over time was to stay 90-100% allocated to public equities. While over recent history, stocks have returned such a level, on average, an investor has seen sizable draw-downs in such a portfolio from the dotcom bubble, global financial crisis, and even the COVID-19 volatility in recent weeks.

As such, the family is unlikely to calmly stomach such volatility. As such, a family’s advisors are likely for the client’s protection, and ultimately their own, encourage them to take less risk in the portfolio – even if that limits long-term return potential. That way – the client can stay the course through the tough times, and the advisor will hopefully not lose a client either.

So what is the thoughtful family to do?

First – is to recognize that difficulty of the task and the near certain inevitably that future generations are likely to not be as wealthy as those who have come before. This can be mitigated by current generations choosing to live below their ability, and thereby gifting to future generations the ability to enjoy the assets at a similar level. As well, the family must recognize that the goal of staying invested together must in fact include more than just the economic benefits alone. The “value proposition” should be balanced to include other measures.

Second, the family must architect an investment approach / strategy that gives them the potential for hitting their targets over the long-run. Consider the typical path that family wealth takes.

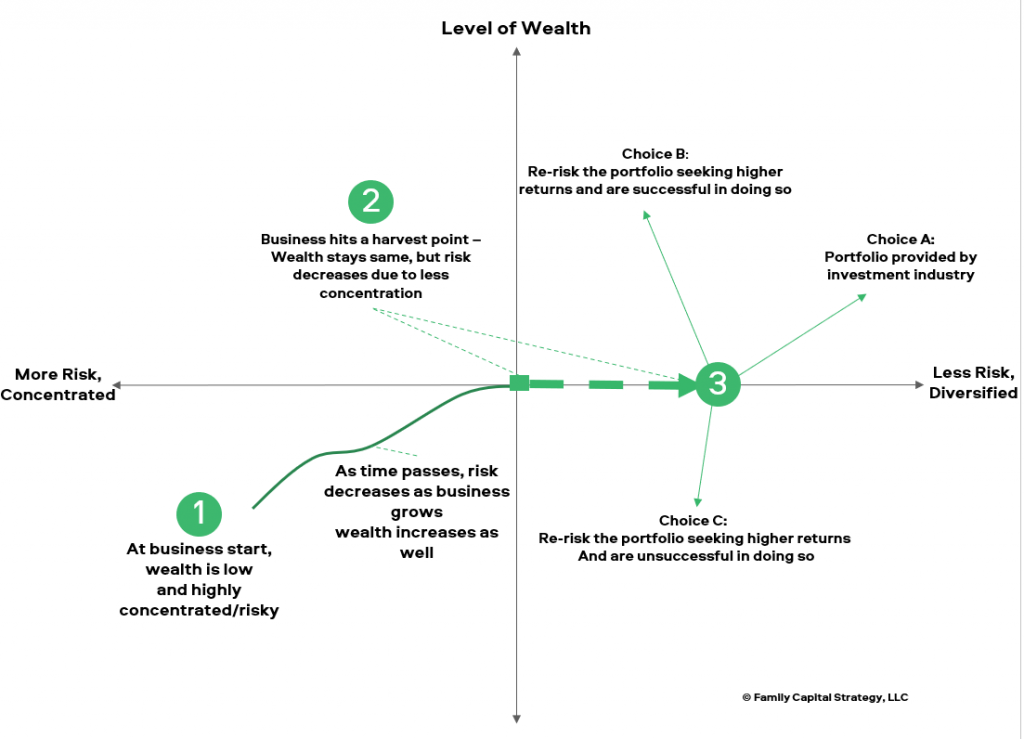

Figure 1. Family Wealth Pathway

Source: Family Capital Strategy

Family wealth starts at Point 1 where overall levels of wealth are low and the assets of the family are likely highly concentrated in the stock of the families business.

Over time, the successful business grows and becomes less risky due to size, market demand, etc. At point 2, the wealth hits an inflection point in the event of the sale of the business. At that point, the family’s wealth becomes significantly less risky as it can be more broadly diversified away from the risk of owning and operating a single asset.

At point 3, the family has 3 possible choices. Option A – it can invest in a broadly diversified portfolio, which will be lower risk and commensurately grow their assets at a lower rate over time. The family could chose option B or C which is to re-risk the portfolio in some way and seek higher returns. If they are successful in doing so, the family’s wealth will be meaningfully higher than the broadly diversified portfolio. Conversely, if the family is unsuccessful, it will have re-risked and ultimately ended up worse off.

This risk of ending worse off, i.e. loss aversion, ultimately pushes many families to pursue conventional investment strategies widely available in the financial marketplace. But for the few that make the choice to take additional risk, and are thoughtful in how they do so, there is the potential to reach the long-term return bogey for the family. In Part 2 to come, we build on this discussion and talk about what it looks like to build such a unique approach.

Disclaimer: This does not constitute investment advice or an offer to buy or sell any securities. It is provided for informational purposes only and represents the author’s own opinions