Today, I want to talk about investment fees and financial advice. This is a tricky subject to evaluate given the number of moving pieces. Within the broader financial advisory industry, it is also hotly debated as technology, new business models, and changing client expectations have led to a proliferation of fee models and an overall decrease in fees paid (in aggregate). I am going to try and reference specific industry figures and where possible, link to third party sources. Much of the consternation regarding fees is that they feel opaque, when in reality there is a ton of data publicly available. Please note that any firms referenced or linked to are not endorsements or recommendations. We have covered some basics for picking investment partners here.

The point of this article is not necessarily to render judgement about the appropriateness of various fee levels. Instead, I want to offer a view as to what ‘average’ pricing runs for various services. Each household/family will ultimately need to determine what their specific needs are, look at what is being offered by the financial advisory industry, and then look at the value delivered relative to the price paid and determine whether or not the fees were appropriate. As the saying goes, price is only an object in the absence of value received.

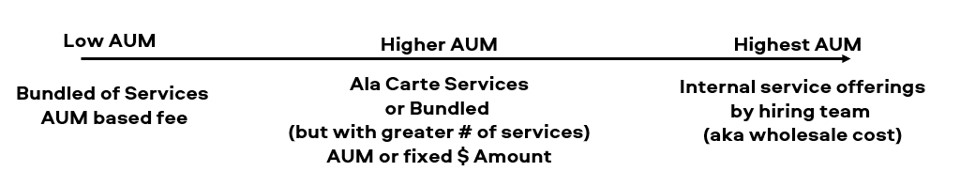

While this piece has broader implications, it is rooted in our firm’s work exclusively with ultra-high net worth families and family offices, which provides a unique vantage point to consider industry fees. Because of their overall level of wealth, family offices are unique in how they access financial advice because they typically ‘buy wholesale’ or ‘buy a la carte.’ Buying wholesale is when the family has enough need that they can hire the person or team to do the work in-house. While more work is required to manage a larger team, there is a cost savings by not having to cover the ‘profit margin’ over an external provider. Where the family office chooses not to build, but rather buy, they are generally able to see the a la carte pricing for a single desired service, as well as the bundled price if multiple services are purchased at once.

Figure 1 – The Investment Fees / Service Scale

The primary challenge in understanding the relationship between fees and value is that the client is paying for a bundled set of services with a single price. As such, it is hard to get a sense for what services really are worth. I believe it is helpful to bucket services together into 3 main buckets.

Investment Fees – Bucket 1 – Administration

The first bucket of services provided to a client are the costs of administering an investment account. Below we walk through the major constituent elements.

Custody and Clearing – The Safekeeping of assets

Custody is a bit like plumbing in your house – at its best, it is not something you are actively thinking about. But when it goes wrong, you can be sure that it will be front of mind. With the growth of technology, custody has become an extremely challenging business to be in. Discount brokerages like Charles Schwab and Fidelity more or less offer custody services for free. Most other custodians, such as BNY, Northern Trust, State Street, etc., will loop in other services to offset the cost.

It is not uncommon to see minimum fees of between $50,000 to $100,000 for large clients, with an average fee below 0.10%. But this is a revenue target from the relationship, which may see custody fees lowered when you are able to use in-house asset management offerings. Custodians may also be using securities held in your account for securities lending purposes which provides them an additional source of revenue.

You can find more about custody services from BNY here or Northern Trust here.

Trade Execution

Let’s touch briefly on trade order management and execution. This used to be a more material cost with per share trading charges of $0.04 – $0.05. Technology quickly lowered that below $0.01 / share. Robinhood dialed up the pressure on the industry and took trading costs to zero – which has been met by the other discount brokerages. Now as the old saying goes, if you are not paying for something, you are not the customer, you are the product. What has become clear in recent months surrounding the trading activity in Gamestop is that Robinhood was offering free trades, but monetizing the order flow by selling it to large market making hedge funds.

Quantifying the cost of trading is exceptionally difficult given that it generally gets incorporated into the cost basis of an investment position. As well, quality of the execution can affect the trading cost.

Paperwork

The advisor may as well be assisting the client with the administrative tasks of the portfolio. As portfolios increase in size and complexity, there is an accompanying increase in paperwork. The use of private partnerships produces subscription documents to be completed, limited partner agreements to be reviewed, and capital calls to be managed – to name a few. Even for more ‘vanilla’ allocations there are investment management agreements for separate accounts, tax documents, corporate actions, etc. This service is basically tied to the time required to complete, and is generally part of the service package an advisory firm offers.

Reporting

The final service provided under the administrative bucket is reporting on the investment account. While the broker/custodian likely produces a statement, the information provided is generally quite limited. Per Marc Andreessen’s turn of phrase that ‘software is eating the world,’ investment reporting is a front and center focus for the financial services industry. Advisory firms are now using technology to provide GIPS compliant reporting (time-weighted, net of fees), comparison of performance to a portfolio benchmark, asset class level performance data vs. benchmarks. For some of the large consulting firms, they may also provide relative performance rankings at the portfolio and manager level. Similar to paperwork, this is usually bundled with the pricing of engaging an advisory firm.

Investment Fees – Bucket 2 – Investment Services

These first four buckets of services being delivered only address the basics of getting an investment account setup and ready to go. The next step is to determine what to do with the assets.

Asset Allocation

Asset allocation is both art and science, but arguably the art is most important. As has been demonstrated time and time again, asset allocation is the greatest source of returns for the portfolio Working closely with the client to understand and determine risk appetite and then marry that insight into an asset allocation approach is exceptionally important.

This client alignment piece is the most challenging part of producing an asset allocation. Tools such as Mean-Variance Optimization, Black-Litterman and other quantitative approaches are in more ubiquitous use now, meaning the science of producing an asset allocation is much more universally available today than in the past.

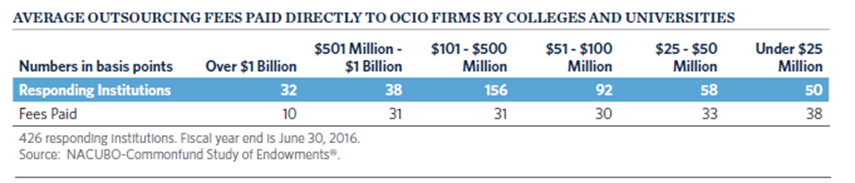

So what is the cost of producing this asset allocation? Investment consulting relationships generally begin with asset allocation (though they may also include manager selection discussed below). That said, consulting firms are a good place to begin for understanding what the likely cost of the asset allocation is to be to the client. Consulting fees are general done on a fixed dollar basis negotiated up-front, with each firm having a minimum relationship size. An additional study of investment consultant fees here shows average fees paid of between 1bps and 10 bps. As the client gets larger, clients typically shift away from an assets based fee, towards a fixed fee pricing arrangement.

Discretion – Who Makes the Investment Decision?

Closely following the asset allocation decision is who will be responsible for implementing the allocation. If the client wants to retain control of the assets, they can engage a firm on a consulting only basis. Alternatively, they can turn over control of the account where the investment adviser is able to implement.

We can estimate what the value of this service is by looking at platforms like Wealthfront and Betterment which provide asset allocations and implementations for low costs. Wealthfront charges ~0.25% for its services (source: here). The implication being that the incremental cost of implementation/discretion is 0.15%.

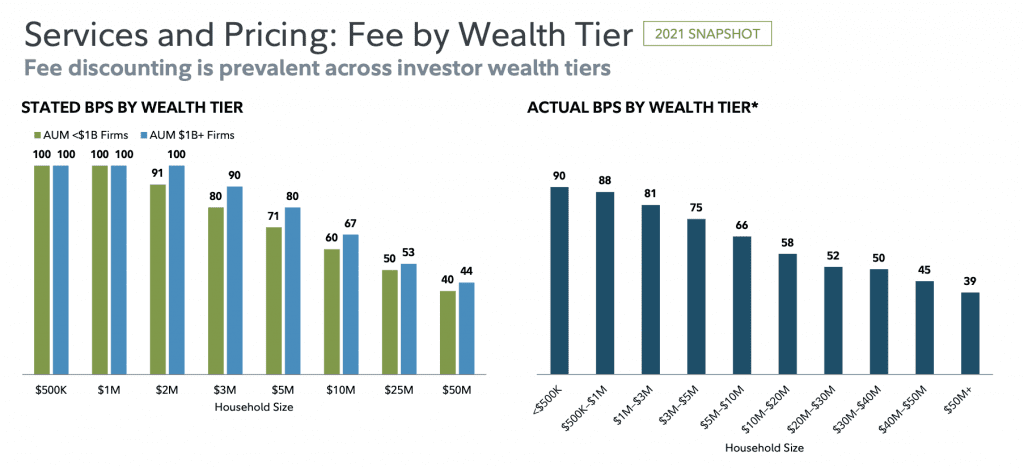

An investor can now efficiently access a diversified investment allocation, implementation, and discretion and only pay 0.25% for the privilege. Yet if we look at industry survey data (Fidelity 2022 data here) – advisory firm clients are typically paying somewhere between 0.40% to 0.80%. So what services are those additional fees being paid for?

Figure 2. Fidelity 2022 Fee Survey

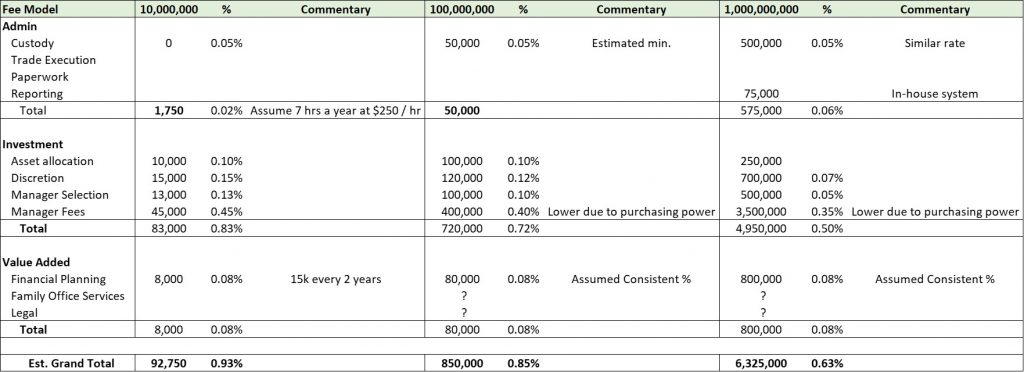

Figure 3. Investment Fees by Size ($10MM+)

Manager selection and access

One additional service for many firms is manager selection. After developing an investment allocation, the advisory firm must specify the preferred way to implement the investment program. One simple and low cost method is to utilize low-cost, index only approaches such as index funds or ETFs.

The other option is to use active management. For many top-performing managers, there is a wait list or limited availability to put capital to work. Firms that have established relationships with such managers offer their clients unique access to such managers.

Let’s us consider the price paid for selection and then take a deep dive look at the potential value delivered.

As we discussed earlier, for consulting only relationships, the negotiated fee schedule includes asset allocation support and manager selection. Using Figure 3 above, which looks at discretionary OCIO relationships and using 0.25% as our baseline for allocation, discretion, and a passive-only implementation, we can back into a figure that suggests that the market is pricing manager selection at about 0.13% (for smaller clients).

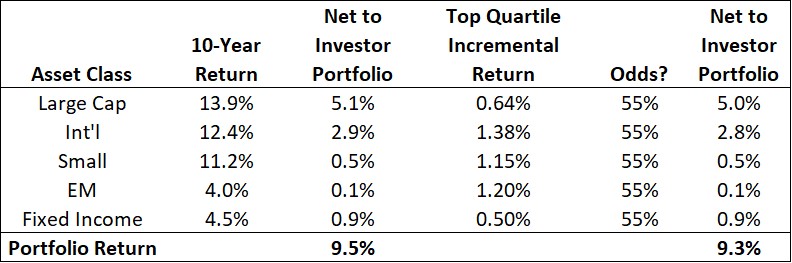

Firms of all shapes and sizes are quick to highlight their manager selection process, but in my experience, very few have done the analysis to determine whether or not their efforts actually add value. Figure 4 walks through our analysis of the potential value add of manager selection. First, our analysis looks at 10-year average returns by asset class. It next considers how the average investor’s portfolio would perform if they utilized an all index fund approach to implement at typical asset allocation for an individual investor. What our analysis shows is that for a 75% stock, 25% bond portfolio, an investor would have reasonably expected a 9.5% annual return net after all-fees and all taxes.

Figure 4. Investor Returns After Investment Fees

The challenge arises when you look at the potential additional returns that a top-performing active manager can add. In the column labeled “Top-Quartile Incremental Return,” we outline the additional returns over the benchmark that the top 25% of managers have exhibited over time. Importantly, we then must handicap the likelihood of the advisor successfully identifying a top-quartile manager. Given that the asset management industry is zero-sum (i.e. winners and losers net to zero), we have generously assumed that the odds of finding a top-quartile manager is slightly better than a coin-toss – which is exceedingly generous. In that scenario, by the time the investor pays the incremental cost for the manager selection efforts + the higher fees of utilizing active management, the portfolio actually sees a lower return of about 0.20% annually.

The active picking of stocks and attempting to outperform an index is exceptionally challenging. As a former fund manager, I can attest to that. The challenge is no less great on those who are attempting to find such managers. The point being though that their process must be exceptionally robust to overcome the cost hurdles of finding and investing with such managers. They must search for managers whose opportunity set and strategy can generate significant alpha relative to a benchmark – and even then the fees paid must be appropriately scaled. No strategy is so great that it cannot be ruined by too high a fee.

The caveat to this is the value of finding great private equity and private real estate managers. The top managers in those asset class exhibit such significant out-performance that the hunt for them can materially improve portfolio results. Sourcing, due diligence and access to those managers may more than offset any of the fees charged by the advisor.

Side note – Manager Implementation

After selecting the manager, there is the question of how to utilize the services of the manager. Common options include a mutual fund, separate account or limited partnership. Some investment advisory firms implement their investment allocations through the use of pooled vehicles.

There are pros and cons to such an approach. Private, pooled vehicles may offer access to smaller clients who could not afford the minimums required to access the funds directly. But where possible, it is often preferable to access a fund directly – that way you, at the very least, own your cost basis.

Investment Fee Offsets

While we have covered some of the costs with having investment advisory assistance, it is important to highlight the additional value that a good advisor can add.

Account Optimization

Advisors will also work to optimize the management of accounts to ensure they are being managed most efficiently. This is generally completed through asset location and tax loss harvesting.

Asset location means making sure that investment assets are located in the most tax advantageous location. Income producing assets should be put in the most tax efficient accounts vs. growth stocks which pay little to no dividends which can be placed in tax inefficient locations. Once assets are located properly that adviser can engage in tax loss harvesting strategies i.e. selling losers to book taxable losses to offset capital gains realized elsewhere.

As an aside, taxes represent a real head wind to investment performance but are very difficult to account for. Investment performance records while generally shown net after fees, typically do not include capital gains or other taxable events. Those gains / losses are generally only received via 1099s and K-1s at year end, which then get lost in the annual tax prep process.

Behavior Management

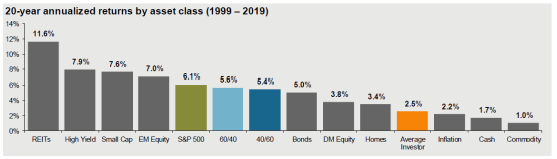

A significant amount of value is added from the adviser in the form of behavior management. As Dalbar and others have noted, the average investor experiences performance significantly less than market indices by inappropriately timing the market.

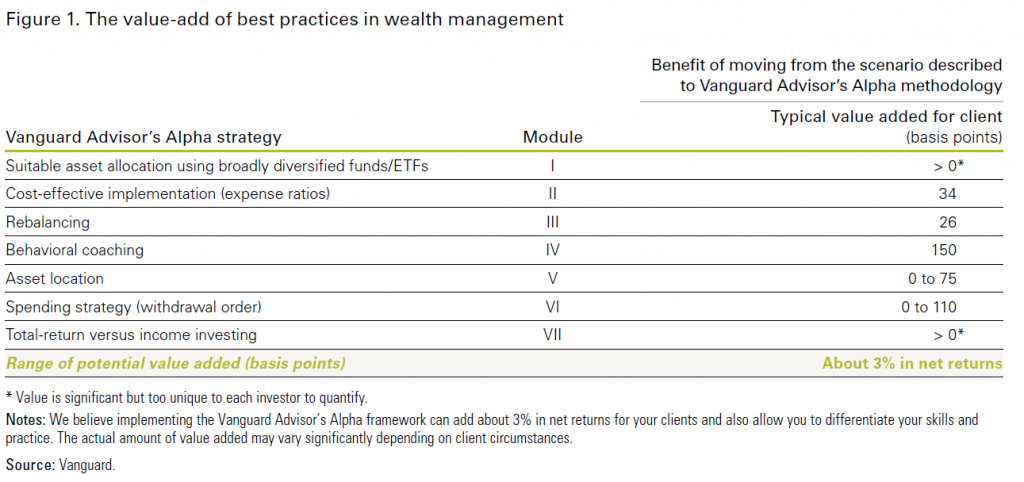

Vanguard which is known for its passive investing approach is quick to highlight the value of the advisory relationship. Below is a table from their Advisor’s Alpha piece which is their best efforts attempt to quantify the value of working with a competent financial advisor. Their estimate is that behavioral support could be worth as much as 1.5% annually to the client.

Investment Fees – Bucket 3 – Value-Added Services

Financial Planning

Perhaps the most common additional value add service provided to clients is comprehensive financial planning. This process helps a client articulate core financial goals and then assesses their attainability. Michael Kitces has done phenomenal research here looking at both the time required and estimated cost of delivery a financial plan.

So what does Kitces’ research show?

First, the average cost of a comprehensive plan is about $2,400. The cost of the plan is influenced by the experience and additional professional expertise that the adviser brings to bear. So a wealthier client with a top tier adviser may pay $10,000-$15,000 for their plan. An advisor may spend as much as 15-20 hours in preparing and presenting the plan, implying an hourly rate for the advisers time consistent with other professionals such as attorneys.

Family Office – Next Gen Education, Family Governance ,etc. Services

Family office services are bit tricky to value. Aggregate fee compression for investment management generally sees a sizable drop off in cost as the asset under management. For a 100MM client, industry average pricing for asset management is in the realm of 0.25% – 0.30%. Yet generally the complexity of the household, combined with the need/desire of the client for additional, highly integrated services means that there is not enough margin to at 0.30% to service the client effectively. As a result, most multifamily offices have increasingly moved to an AUM fee + a retainer to cover these additional services.

The Family Wealth Alliance is the definitive source on these models. There is a comprehensive interview with Tom Livergood, Founder and CEO of the FWA here regarding what they see as evolving fee models within the industry. The key question for the higher net worth client is whether or not there is enough complexity to warrant the additional cost.

Investment Fees – Bucket 4 – Incremental Services

In addition to the services mentioned above, which are typically bundled, within a single fee. Investment advisers may offer additional services that are delivered on a separate fee schedule

Tax Return Preparation

Preparation of tax returns is a service that some investment management firms have chosen to bring in-house, while others still prefer to let the client utilize a third party accounting firm. Generally, this is delivered on a separate engagement letter and terms.

Trustee Fees

With the vast majority of family wealth landing in trusts by the fourth generation, it is not surprising then that many of the firms that work with the wealthiest clients have the ability to offer trustee services. Additionally, directed trustees that provide trustee, but not investment services are a rapidly growing piece of the industry. Trustee fees are often times negotiable based off the complexity of the trusts assets and the cost to service it.

You can get a sense of industry average pricing by looking at the following:

- Pershing – Schedule includes Advisory Trust, Reliance Trust, Sante Fe Trust and Wilmington Trust

- Vanguard National Trust Company – fee schedule here

Other Professional Advice – legal etc

Let’s also assume that over the course of the year, additional professional services are going to be required. Importantly, preparation of tax returns and the delivery of tax advice are very different propositions. Attorneys may be engaged at various point to assist with trust planning, as well as work on tax related matters.

Hourly rates for attorneys can be difficult to compare on an apples to apples basis. Survey data tends to cluster around the largest firms, which generally engaged for corporate work. If the survey is national in scope, composite figures are generally quite low due to solo practitioners or the rates in rural markets.

With that in mind, here are a few context setting points regarding attorney fees:

- In 2020, the biggest law firms are charging over $2,000 an hour for partner time (and over $1,000 for associates) (source)

Assuming that a wealthy family will need top flight advice, it seems reasonable to expect hourly rates in the $650-$950 / hour range – assuming that the family engages a top tier regional firm, but not a firm with a national or international practice.

Conclusion

So how to put it all together? As you can tell, there are a tremendous number of moving pieces. Below is an example analysis of how fees might work for the $10MM, $100MM, and the $1bn client. Remember, this piece focuses primarily on investment fees and does not consider the other activities that a family office might engage in. (see our whitepaper on family offices here). As such, you will see question marks next to many of the fee categories.

One clear take-away to highlight is that investment managers still receive a significant proportion of the overall fee pool. Certainly one option is to choose an all passive implementation for the portfolio and lower fees. For the $1bn example, the dollar figures get large enough that hiring a team becomes feasible and may offer meaningful savings.

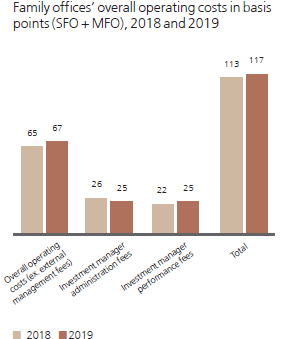

These are definitely rough estimates of how fees might be spent, but they are in the realm of reason. UBS publishes an excellent annual family office survey (here) that has shed some light on operating costs. Below is one dis-aggregated look at operating costs for single and multi-family offices. As you can see below, their fee calculation is not far off from the above.

As we began, the point of this analysis is not to render judgement about the appropriateness of any fee charged. Instead, it is to lay a framework of how best to think about fees (the 4 fee buckets) and then give an indicative range of value. Arguably, when looking at the value of the service provided, solid financial advice more than warrants the price paid, as long as it is within a realm of reason.

Disclaimer: This piece reflects the author’s opinion and may change at any time. It does not constitute an investment recommendation or an offer to buy or sell any securities. Please consult relevant professionals for specific tax, legal, or investment advice.