Too Many Fish in the Sea?

Last week in Part 1 of our series, we looked at the role of the family itself in doing “good deals” and why the family itself can either be an asset or liability in any sort of direct investment strategy. Specifically, we considered whether the family is a builder of a single business or a builder of multiple businesses? We also considered the odds of building a single business to a large exit, and the need for the family to soberly assess its human capital. While certainly skill and hard work is involved, every family that builds a sizable business also benefits from luck. As such, parsing the lines between the two is a necessary precondition for determining whether the family does or does not possess real skill in building businesses, and whether this skill might actually be transferable to other business ventures.

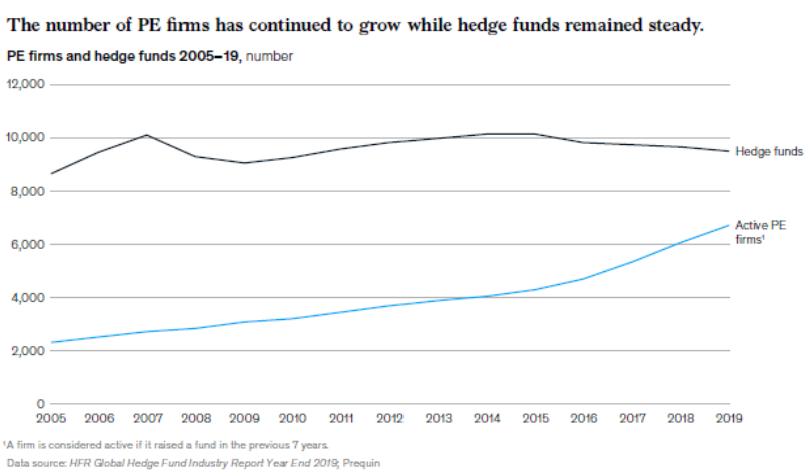

While deal making may be an activity a family desires to engage in order to further grow its financial capital, they are not alone in that pursuit. Today, we are going to shift our focus and consider the other players on the deal-making field. Make no mistake, the private equity industry has evolved tremendously since its “cottage” days of the 1980s. Perhaps more interesting is the rapid acceleration in in the industry over the last 15 years. Since 2005, the number of PE funds has grown by nearly 200%.

Source: McKinsey

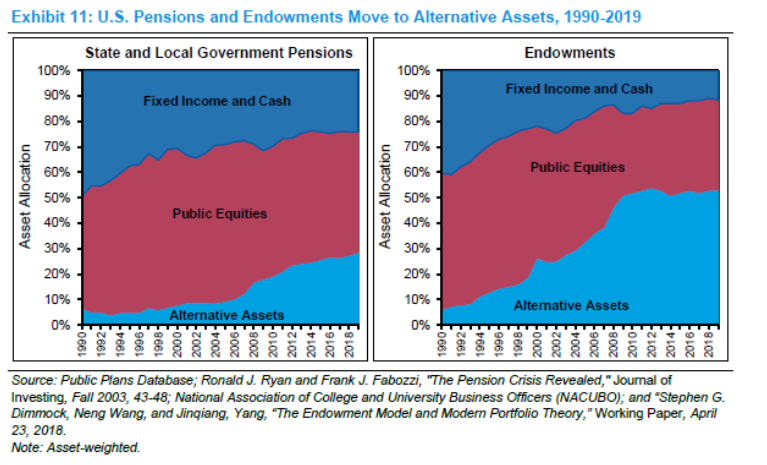

This growth in assets under management has been funded by a massive increase in allocations to alternatives by the endowment/foundation and pension community. While Yale and others have had sizable private equity allocations for decades, the sheer massive size of pension pools has seen massive inflows of capital to the industry as those allocations have shifted in recent years.

As can be seen from the Figure below, much of this ‘secular shift’ to private equity is now behind the industry. While tactically pools of capital may be relatively under/over-weight their PE allocation due to their view of market conditions, the bigger shifts to sizing up the asset class in the strategic asset allocation are behind the industry.

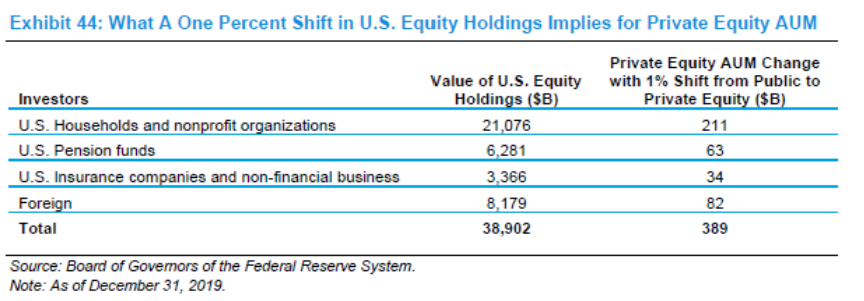

As the Chart below highlights, from a pure flow of new funds to the industry, the next greatest pool of opportunity for the private equity industry will be to increase PE holdings within US households. Accredited investor rules and high fund minimums have kept the average high-net worth investors largely out of PE for the most part. Expect further efforts to increase accessibility of this asset class.

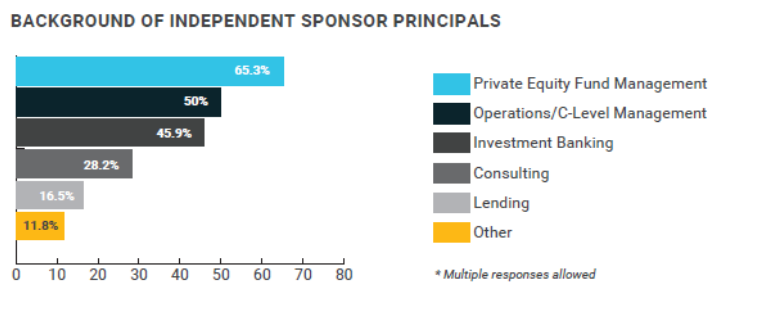

Independent Sponsors too

But the competition for the purchase of private businesses is not just confined to the activities of the private equity community. The Independent Sponsor Community is rapidly growing as well. Independent, or alternatively known as “fund-less,” sponsors pursue acquisitions without a fund vehicle in place, instead choosing to raise capital on a deal by deal basis. Crain’s NY estimates 250 active independent sponsors in market. As the Figure below indicates, independent sponsors bring strong skillsets, but are choosing a different path that staying within an existing private equity industry.

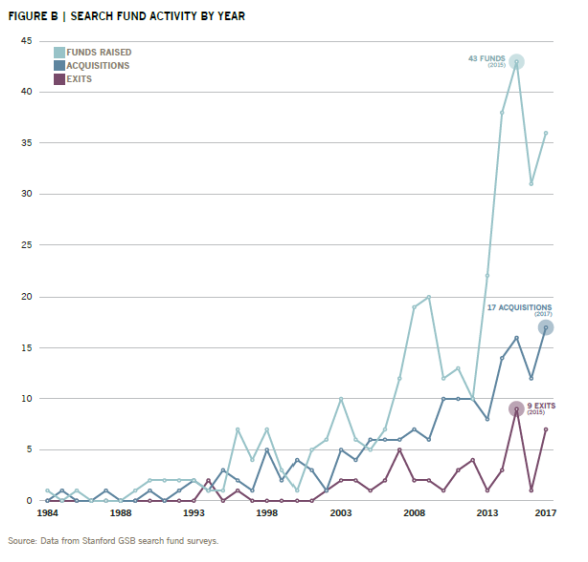

Similar to the independent sponsors are the search funds. Search funds are a rapidly growing career path for the post-MBA cohort. Rather than returning to Wall Street or large consulting firms, searchers raise a pool of capital to fund expenses (and modest comp) while searching for a business to run. A Stanford survey below highlights the number of funds active in the marketplace.

Search funds

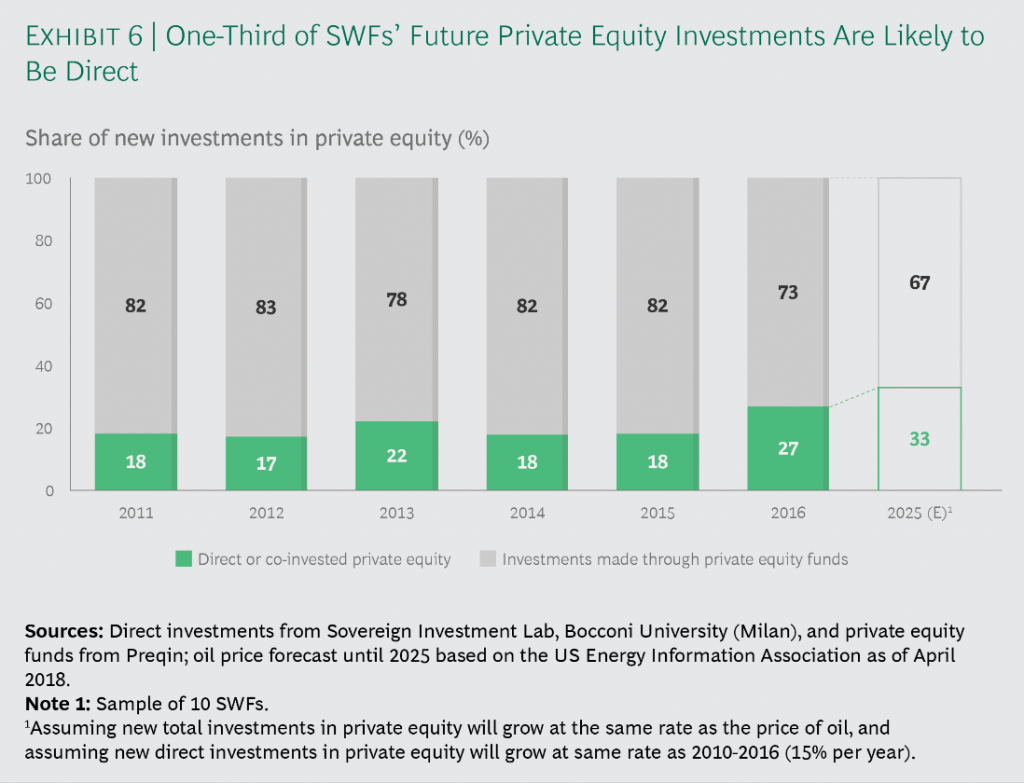

Sovereign wealth

Similar to family office, global sovereign wealth funds are increasingly looking to go direct with their private equity investments. While historically SWFs have not been staffed to manage direct investment, the perceived success of direct programs within the Canadian pension system alongside the significant fee saving potential are accelerating interest in this massive channel. Data below from Boston Consulting Group highlights the rapidly increasing exposure of sovereign wealth funds to direct PE.

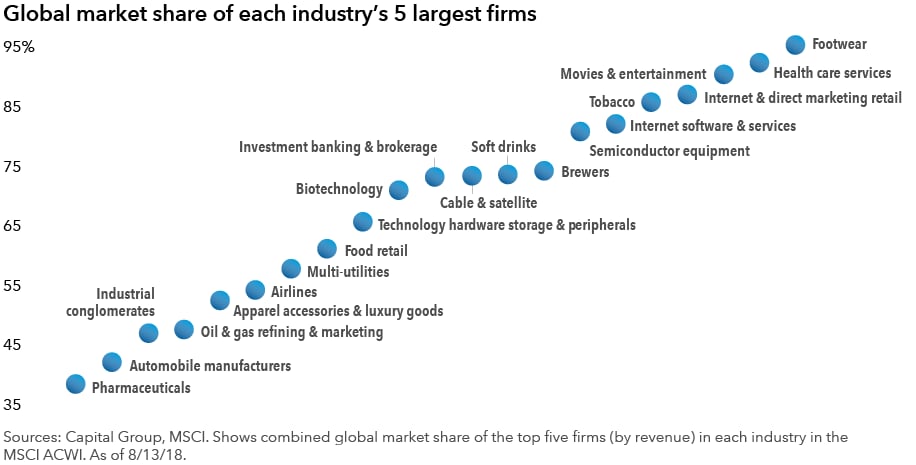

Of course, let’s not forget the activity of ‘strategic’ players in any industry as well . Large established businesses in mature markets continue to rely on M&A as a pathway to grow. As well, given the diffusion of corporate finance skill sets into the broader corporate infrastructure, large multinationals approach M&A with a significantly greater level of sophistication and acumen than in years past.

Investment management firm Capital Group highlights the significant consolidation that has occurred in most markets globally. As can be seen below, in many market, the top 5 competitors in an industry may easily have 70%+ market-share.

This level of consolidation means that it is highly likely within any industry vertical, there are a few major players who will actively be looking for ways to grow.

Finally, there are the family offices themselves. A recently released Fintrex (conducted with Charles Schwab) study estimates that 50% of the 3,500-5,000 global FO’s are engaging in some form of direct investment. Per UBS’s 2020 Family Office survey, 16% of FO assets are focused on private equity, with more than half of that allocation for direct investment.

So what does this mean?

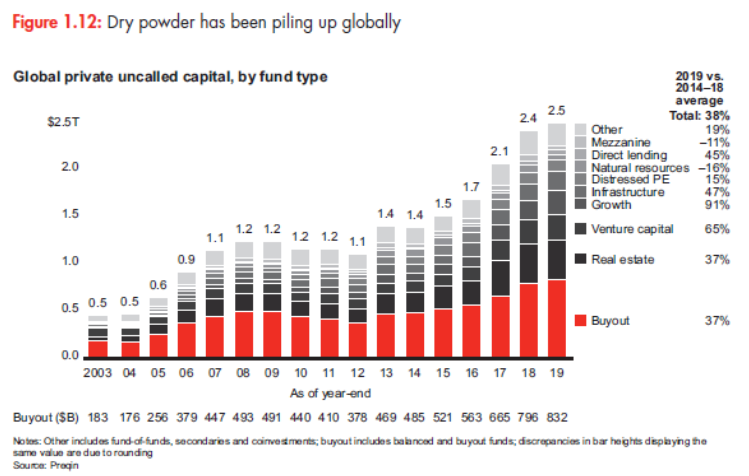

As we have outlined, right now, there are 6,000 plus private equity funds, several hundred independent sponsors, several hundred search funds, sovereign wealth funds, strategic players and additional family offices all actively looking for acquisitions. Speaking to the PE funds alone, there is $2.5 trillion in dry powder that has been raised and is waiting to be deployed to complete transactions.

In the past, buying businesses directly has been appealing due to the potential for out-sized returns. These returns were driven by the ability to buy cheaply, aggressively grow the business through additional M&A, and streamline operations. Combined with a longer-term horizon (3-5 years), limited need to mark down assets during short-term volatility, and the potential to utilize leverage to further enhance returns, it is easy to see why PE generated such strong returns. In fact, arguably PE was just what the doctor ordered to enhance the competitiveness of a sluggish US corporate sector coming out of the 1970s.

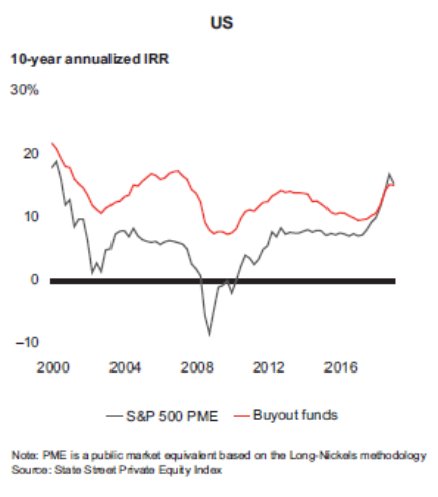

But this isn’t 1980 anymore, and the industry has matured greatly. Large levels of capital and a broad diversity of investors looking at deals has naturally led to a much more efficient marketplace. The low hanging fruit to drive returns has been picked. And even despite the factors mentioned above, as Professor Ludovic Phalippou recently published, private equity funds have had similar returns to public securities since at least 2006 (An Inconvenient Fact: Private Equity Returns & The Billionaire Factory). The Figure below is from the consulting firm Bain, but expresses the same conclusion.

Private Equity vs. the S&P 500

For family offices pursuing direct investments, the simple fact is that they are not alone in their efforts. Those pursuing the same deals may in fact offer more capital and more experience in acquiring businesses. As such, the family must be cautious to not be “the patsy at the poker table” with such sophisticated competition surrounding them.

Disclaimer: This does not constitute investment advice or an offer to buy or sell any securities. It is provided for informational purposes only and represents the author’s own opinions