“Water, water, everywhere, but nary a drop to drink”

For the last several years, doing ‘direct deals’ aka buying businesses outright vs. investing in private equity funds has been en vogue for family offices. The allure of potentially higher returns, lower fees paid to private equity sponsors, and a chance to utilize the family’s ‘human capital’ in building businesses makes this a tempting strategy to undertake.

Yet far too often, family offices go down the direct investing path without much strategic direction other than wanting to ‘only do good deals.’ In this multi-part series, we are exploring the challenges a family may face in going down such a path. Our first post looked at the ‘human capital’ of the family and whether or not they actually have a replicable skill-set in building multiple businesses.

Last week, we pivoted and looked at the competitive landscape and the sheer number of other firms also engaged in the business of M&A. We observed that there are 6,000 plus private equity funds, several hundred independent sponsors, several hundred search funds, sovereign wealth funds, strategic players and additional family offices all actively looking for acquisitions.

This week we shift our focus away from demand and look at the supply of deals available – or deal sourcing. First consider some aggregate statistics. There are an estimated 200,000 businesses with between $10MM to $1bn in revenue per the US Census/D&B. Research conducted by Barbara Roberts at Columbia University highlighted that there are 20,000 US companies with $100MM in revenue who have never raised outside financing. Additionally, Roberts notes that there are another 80,000 companies with revenues of $15-$100MM that have no outside investors. Of course, there are an additional 3,800 or so public companies in the United States. McKinsey noted that private equity sponsors owned ~8,000 companies as of 2017. These figures are not meant to be additive, but instead can be helpful to triangulate the overall opportunity set. With such statistics as these, it would seem to indicate that despite a competitive buy-side environment, there are a reasonable supply of potential investments available.

Drinking From a Fire-hose

Yet despite an ample supply, sourcing quality deals is by no means easy. Sutton Place Strategies, an advisory boutique that helps PE firms develop their sourcing capability, publishes an excellent set of statistics on deal activity in the private equity world. SPS notes in the lower middle market and middle market, firms typically have 1 full time professional tasked with exclusively with sourcing.

Funds review on average close to 1,000 potential opportunities from several hundred intermediaries. Yet despite this level of activity, they have only seen ~18% of target market deal flow. Meaning they would need to review close to 5,000 opportunities annually to see every possible deal in their target market.

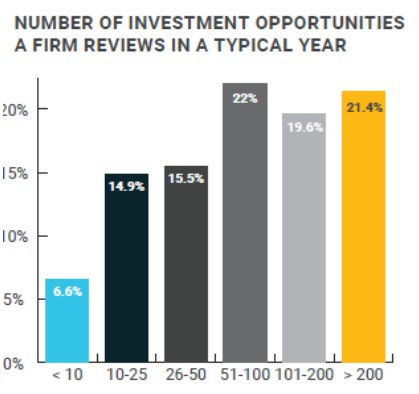

Citrin’s 2018 report on the independent sponsors community supports a similar conclusion regarding the level of activity, with 40%+ of firms reviewing in excess of 100+ deals per year.

The implication of this level of activity is that structuring and then managing the top of the deal funnel will be of critical importance. Seeing several hundred to a thousand deals a year is a logistical challenge. First there is the challenge of building relationships with intermediaries (investment bankers, business brokers, etc.) who have deal flow to share. This is of course separate from any direct outreach to engage companies directly. Keep in mind, many private equity funds have teams dedicated to originating deal flow independent of the intermediary channel.

One other dynamic that may be unique to a family’s deal flow is managing the “my friend with a deal” phenomena. Any family of material wealth is likely to have family members with friends who would be highly interested in doing business with the family. They are quick to present these opportunities to family members at the typical social gathering places of the well to do – luxury resorts, tee boxes, etc. The family will need a clear policy and process of how best to manage such ‘relational’ deal flow.

Once deals come in the top of the funnel, the next task is to quickly screen out those that are not worth pursuing further. For example, say you target seeing 300 deals per year. With ~250 business days per year, so that would be about a deal per day pace. In order to manage this flow, there must be a defined screening process to quickly discard deals that do not fit, so that higher potential deals can come to the surface.

As you can imagine, this level of activity likely requires a team of some size, generally 3 at a minimum, in order to manage the activity level. As well, is a technology architecture to manage relationships, and in-bound information, NDA’s, CIMs, etc. Yet, this just marks the beginning of the deal process. In addition to the sourcing activity, the team then has to move deals along a process towards closing. And bringing a deal to close is by no means certain. Sutton Place estimates that only about a third of deals in a firm’s deal pipeline will actually ever close.

So What Does This All Mean for Family Offices?

First – deal sourcing must be taken seriously. In order to see deals relevant to the strategy of the family office and ensure they are of sufficient quality, the office needs to build a structured and repeatable process to identify deals. Second, the team matters. The team will need to be large enough to manage in-bound flow, move active acquisition processes along, and handle the day-in and out of existing portfolio companies. Third – while there be a lot of potential companies, when the list is narrowed down to the right businesses, of the right quality, the pool of opportunity shrinks down quite quickly. It is not uncommon to see a 1% or lower rate of deals identified to closed. Family offices must be prepared to maintain their selectivity if they are going to generate returns that warrant the headache and illiquidity that comes from buying businesses.

Disclaimer: This does not constitute investment advice or an offer to buy or sell any securities. It is provided for informational purposes only and represents the author’s own opinions