We have considered in previous posts the pace at which a family must see their assets grow over time to keep pace with the growth of the family. In our first post on the subject, How Fast Must a Family’s Asset Grow?, we estimated that a target rate of return of 9.8% annualized is a reasonable starting place based on the hypothetical circumstances and assumptions used.

Since then, we have evaluated several dynamics that affect that target return rate. Certainly, investment strategy plays a key role – – i.e. how to even consider reaching for a target that high (see part 1 and part 2). That said, the two largest drivers of that 9.8% though are the growth of the family and distribution rates to the family. And let us be honest, the idea of some sort of wholesale family-planning initiative is clearly way beyond the scope of our work at Family Capital Strategy and sounds like a family dynamics disaster waiting to happen. Instead, focusing on distribution rate might be a more helpful place to begin. We have called the Distribution Rate – The Only Variable a Family Can Control in Investing.

Today, we would like to connect a few threads that have been spread across several posts. Two weeks ago we discussed how stewarding a family’s wealth is like building a bicycle. The purpose of the analogy was that for a family to persist for the long-term, there are three tasks that must be undertaken – they have to manage and harness the priorities of the individual, align the family overall, and then develop a strategy to reach those ends.

The challenge is that individuals are not great at articulating their priorities for their wealth (and hence why I wrote my forthcoming book). But it is not just individuals, families alike find discussing wealth to be extremely challenging. We have said previously in our post It’s Never About Just the Money, But It’s Never Not About the Money, “too often discussions about the real-life, brass tacks implications of wealth are either never held (most common) or are perceived/received as ‘spend shaming,’ rather than helping families members think strategically about their wealth and engage with how it can be a positive force in their own lives and communities.” Reaching a sense of group consensus about the strategy behind the Family’s wealth is no easy feat.

Thus, while the distribution rate may be the only controllable variable, it is easily the most dangerous to family unity. Stepping between a family and its distribution rate just might be in the same level of danger as a dog and its bone. Finding a way to navigate this tension can be key to the multi-generational success of the family.

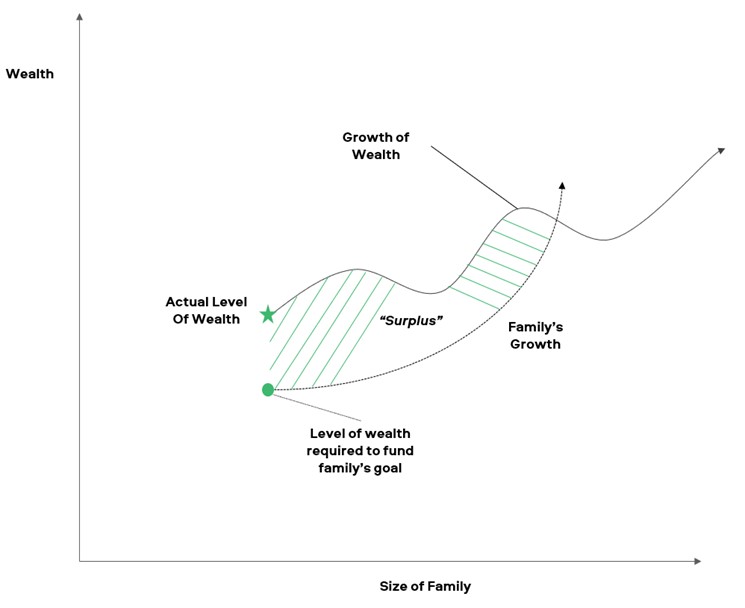

One illustration we have used in the past to explain this is our Family Wealth Surplus diagram. What the diagram attempts to show is that if the family is willing to ‘live below its means,’ it meaningfully extends the period of time before the growth of the family catches up with the family’s wealth.

Figure 1. Family Wealth Surplus

If the individuals and family collectively can reach consensus about the goals their wealth is to support, they can set a distribution rate that effectively creates the shaded green “surplus” area when those goals are below the maximum potential of the current level of assets.

So how does a family begin to navigate these waters?

First, we would suggest that the work should begin cautiously, and start at the individual level. Money and its accompanying concerns hit at many of the most core questions of what it means to be human. Each person will need to begin doing their own work – otherwise, individual concerns / issues have a way of being brought into and relocated into collective discussions. This sort of transference of the problem can derail a group’s longer-term ability to reach consensus on a course of action.

Second, wealth creators should tread lightly. Estate planning attorney, Charles Lowenhaupt noted in his book Freedom From Wealth, “The systems and thinking [of the wealth creator often] become fossilized into structures, family offices, and family dynamics even after the wealth creator at the center of those systems and thinking has died – a rock-hard shell of governance, mineralized around an empty center.” This ossified structure with a hollow core we would point to as being responsible for the 70% of estate ‘failures’ that Williams and Preisser noted in their seminal survey of 3,250 affluent families. As well, it is well documented and accepted wisdom that the financial advisors are changed 90-95% of the time during an estate transition.

All this to say, the entrepreneurial directedness and ability to get things done – core characteristics that led to the success of the wealth creator – can become liabilities if used too forcefully at this stage. Instead, the north star of keeping the family together must be kept in mind, even if the process feels inefficient or fraught with difficulty.

Third, go slow to go fast. There is an old saying that what is first received as a gift, next becomes an expectation, and finally an entitlement. Said differently, once a behavior has begun, it can be hard to change the default. Rushing to make a decision that is not fully baked can do much greater harm in the long-term than being ‘tardy’ to the start line. Families should cautiously set new policies as they make their investment decisions together.

A “surplus” of family wealth is a gift that current generations give to future generations by voluntarily choosing to limit the benefits from wealth that the current living generations receive. This sort of abnegation is a compact that the family must enter into collectively – not coercively – with the mindset that there are greater rewards that arise from seeing the family’s continued prosperity for generations to come vs. the consumption of financial resources by current generations. Giving such gifts must be done thoughtfully and carefully, lest future generations feel the ‘weight’ of the gift as unbearable – whether due to actual or perceived ‘strings’ attached.

The task of future generations is to learn to receive such a gift well and over-time to reach a level of wisdom and maturity by which they will offer a similar gift to their own future generations. We will talk more in future posts about the challenge of twenty-somethings who are working to individuate and find their life’s work but are simultaneously embedded in highly collective family cultures. This is a unique paradox for families to manage.

For More Info – see my forthcoming book When Anything is Possible – Wealth and the Art of Strategic Living. To learn more, as well as receive a free chapter about establishing your Wealth Identity – visit here

Disclaimer: This does not constitute investment advice or an offer to buy or sell any securities. It is provided for informational purposes only and represents the author’s own opinions. Target rates of return are unique to individual family circumstances. Readers are encouraged to contact their advisor to discuss factors that go into their own target rate of return